I invest in hardware. I split my time between factory floors and investment committees, so I see how money works in the real world. The last decade in robotics tells a clear story: Robotics has broken its curse-of-growth loop and is compounding on real deployments. It’s on track to be one of this decade’s strongest trends.

TLDR

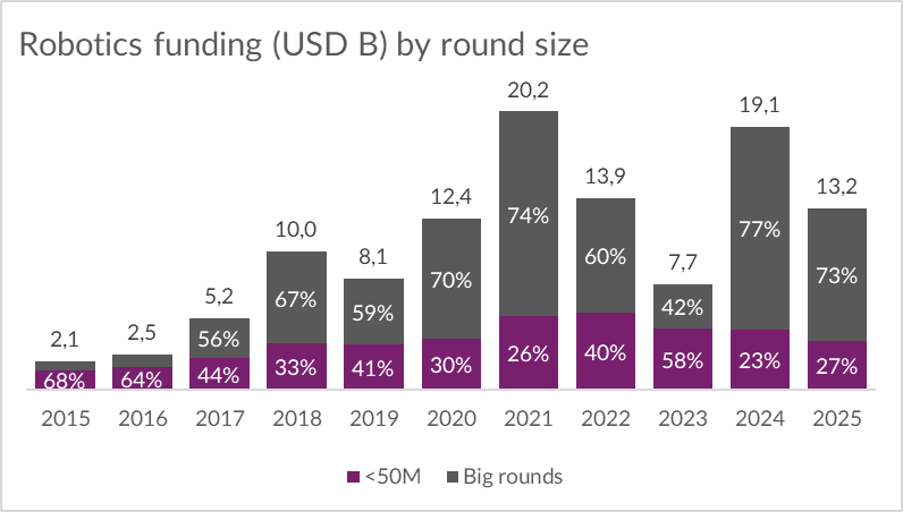

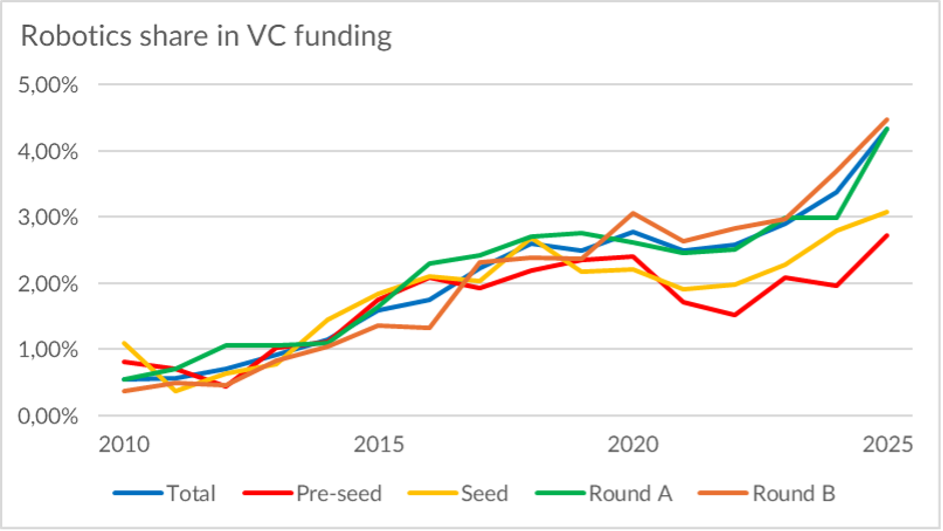

- Robotics’ share ~3× (1.6→4.3%); 2024 hit 5.58% with ~2.64× YoY vs market ~1.11×. Sub-$50M early-stage is near ATH; 2025 could top $4.5B.

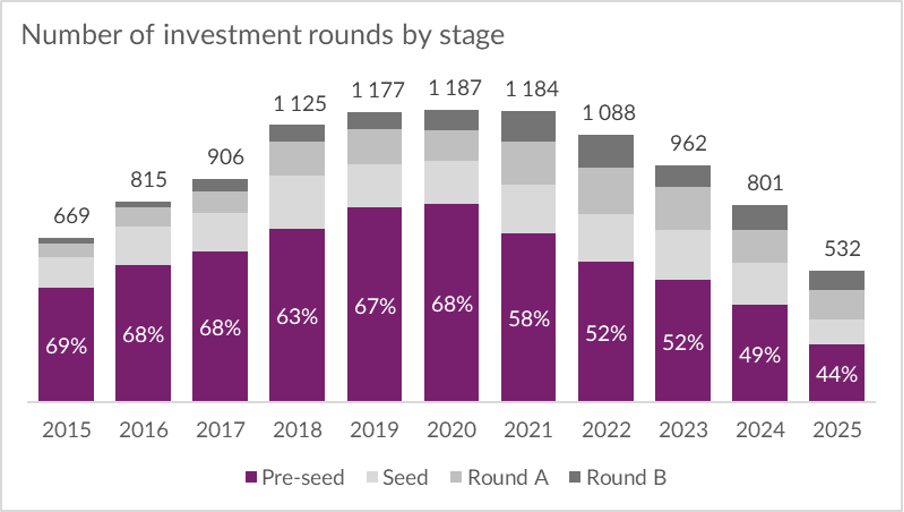

- The pipe is maturing: fewer pre-seed, stronger pre-seed→B progression; Series A ~2.3× vs 2015; average rounds +10–20% vs market.

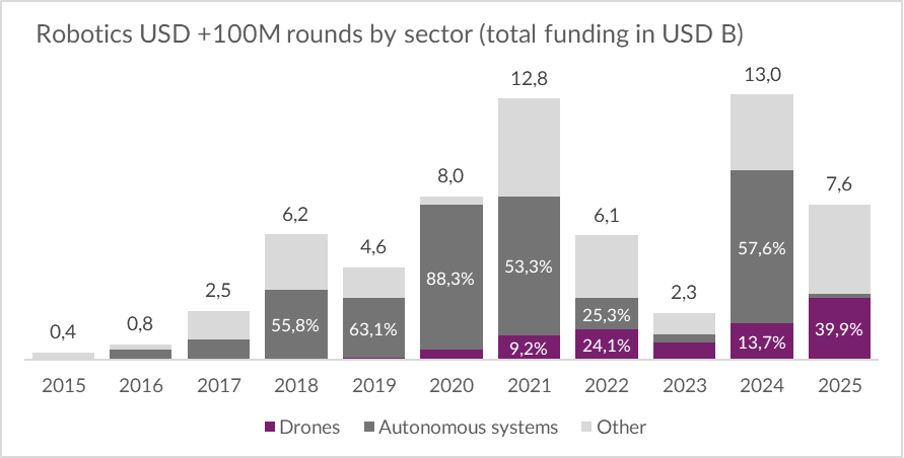

- Since 2020, $100M+ mega-rounds ≈60% of category capital; 2025 YTD drones ~40% of such rounds.

- Capital is concentrated: 2018–2025 top-5 raised $31.12B (~26.6%); North America ≈82% of top-100 round value.

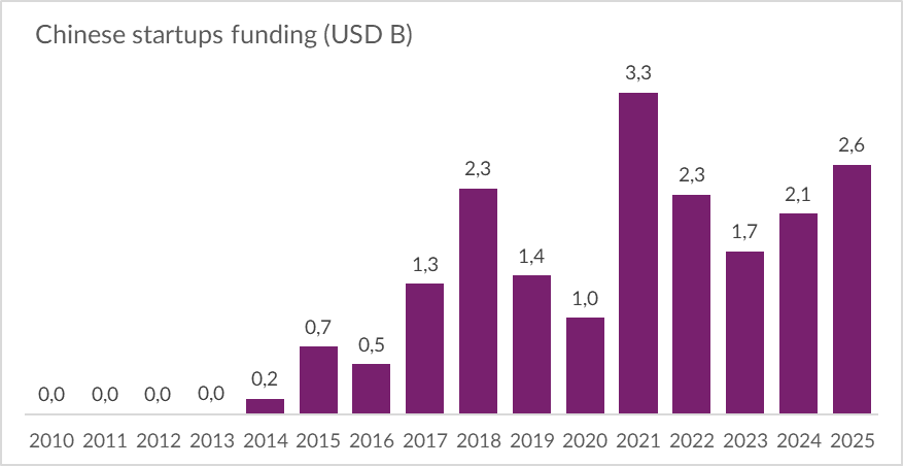

- China leads by penetration at every stage; ~1 in 10 Series B there is robotics; 2025 YTD already > 2024 (a record year).

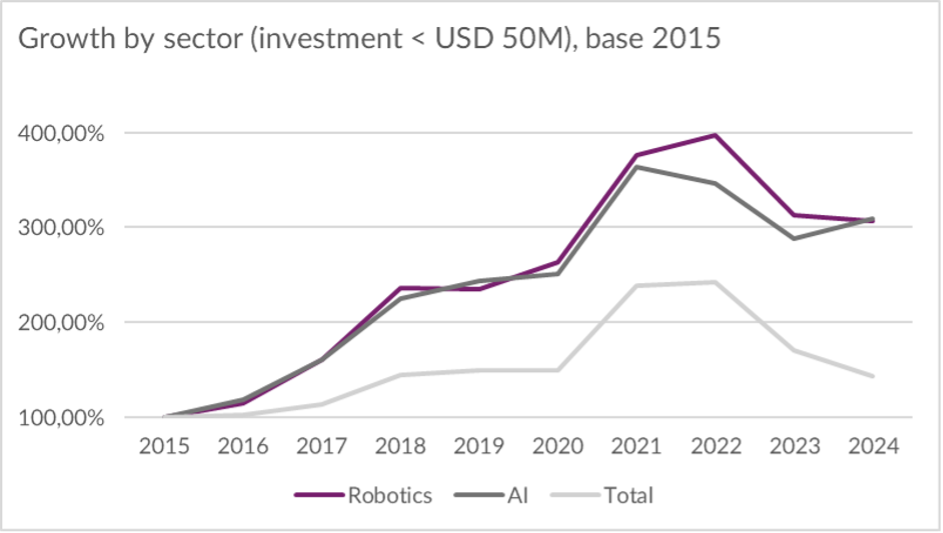

Robotics grow faster than AI

Now for the fun part – the robotics tape. In 2024, robotics captured a record 5.58% of all startup funding. Year over year, robotics dollars grew ~2.64× while the broader market barely managed ~1.11×. Yes, part of that base effect comes from a dearth of mega-rounds in robotics in 2023, but the bigger story is the underlying, long-range trend: the category keeps compounding.

What does growth look like once we strip out outliers (rounds under $50M only)? Early-stage robotics funding climbed from $1.4B to $5.6B in 2022. In 2025 it’s tracking around $3.6B with a realistic shot at >$4.5B by year-end – good enough for the third-best annual print on record (and the best outside the 2021–2022 boom). Over the past decade, robotics’ share of startup funding rose from 1.6% to 4.3%. A ~3× share gain in ten years puts robotics in the same conversation as the hottest segments, including AI.

Less early stage investment, gibber tickets

Robotics has materially outperformed the market over the last decade, with growth roughly twice as fast. Still, even within sub-$50M rounds we see the same structural shift others do: fewer pre-seed deals as a share of activity, fewer early-stage rounds than in 2015, and a pronounced move up-market. Series A volumes are ~2.3× higher than a decade ago, and Series B has also climbed, albeit from a smaller base. The pipeline is maturing.

Is this investors getting pickier about hardware – or simply fewer teams choosing to build it? Either way, the outcome is similar: the segment is professionalizing. What remains are top-tier teams with deliberate go-to-market plans and real technological moats.

Importantly, the dip in pre-seed and seed is not unique to robotics; early-stage counts have been sliding since 2021 across the board and are unlikely to inflect meaningfully in 2025. The difference is that robotics’ decline is milder. That shows up in share: robotics is taking a larger slice at every stage, and that slice tends to grow with later rounds.

Two dynamics explain the step-up between stages. First, robotics companies raise larger rounds on average—about 10% above market norms, and closer to 20% for manufacturing-heavy models. Second, progression is stronger: more robotics startups make it from pre-seed to Series B, and the classic $1–4M seed is relatively rare. The best teams often raise a meaningful pre-seed and then leap straight to a bona fide Series A – more evidence of maturation and capital efficiency.

A 4-something-percent market share might not turn heads today, but hold this trajectory and robotics clears 10% within the next decade. Not bad for a sector “nobody invests in.”

Big wins in robotics are concentrated in two solution types.

Among robotics companies founded after 2015, only 39 have reached unicorn status – just ~2.9% of the 1,342 unicorns created globally over the past decade. On a surface read, that looks underwhelming versus software-heavy categories. But the late-stage funding tape tells a different story about what’s coming next.

Look at $100M+ “mega-rounds.” In 2015 there were only two at that scale – Roborock ($250M) and Auris Health ($150M). Ten years on, aggregate late-stage capital in robotics is more than 30× larger. Since 2020, mega-rounds have accounted for roughly 60% of the category’s total funding, and that pace isn’t slowing. Translation: the pipeline is maturing, business models are de-risking, and investors are underwriting scale with real conviction.

If you asked me – purely from the data – where the next hardware unicorns will come from, I’d point to autonomous navigation and drones. Both have a dizzying range of use cases and slot neatly into B2B value chains across logistics, inspection, manufacturing, warehousing, energy, agriculture, and security. They monetize not just through units shipped but through software, data, and services wrapped around the platform – exactly the kind of flywheel late-stage capital loves.

Autonomous systems have long dominated the robotics unicorn set, but drone momentum has been building nonstop since 2020. Year-to-date in 2025, drones account for nearly 40% of all $100M+ rounds in the category. As regulations stabilize and operating envelopes expand – from line-of-sight inspection to routine logistics and perimeter security—the addressable market widens and unit economics improve. Expect drones and autonomy to keep punching above their weight in the “big wins” column.

What do they have in common? Ground autonomy and drones are two faces of the same paradigm: software + data + real-world operations. The winners are the teams that:

- embed into critical, repeatable B2B workflows,

- deliver hard ROI with enforceable SLAs,

- keep integration overhead low,

- add a defensible edge built on fleet data and compliance, and you have a compounding advantage that scales with every mission flown or mile driven.

Heavyweight bout: a U.S.-style knockout

From 2018 to 2025, the top five robotics startups pulled in $31.12B – about 26.6% of all capital raised by robotics globally over that span. Put differently, one in every four dollars committed to the category landed in just five names.

TOP5 comes from one country, these are

- Waymo ($11.10B),

- Cruise ($9.05B),

- Anduril ($6.13B),

- Argo AI ($2.60B)

- Nuro ($2.24B)

The regional picture around the biggest checks is just as lopsided: within the top-100 rounds by size,

- North America – 34 represented companies and ~$43.8B (~82.3% of value),

- Asia – 19 companies and ~$6.14B (~11.5%),

- Europe – 7 companies and ~$3.29B (~6.2%).

Capital concentration at the late stage is real and it favors U.S. platforms with scale, defense adjacency, and mature autonomy stacks.

Remember!

Round size doesn’t guarantee success. Argo AI raised billions yet shut down in 2022 after Ford and VW withdrew support; Cruise secured an $850M lifeline in 2024 from GM and then faced sharp cuts and a change in ownership stance. For LPs and investment committees, the lesson is clear: in hardtech, operational execution – safety cases, regulatory clearance, and contracted revenue – is existential, even when the ticket sizes set records.

There’s a clear king – but how long does the crown stay on?

U.S. companies still dominate robotics. Europe looks stagnant, with founders tripping over regulatory frictions. And then there’s China – leaning in hard on robotics and deep tech, with policy tailwinds and capital intensity that are impossible to ignore.

| Robotics share in total funding (# rounds) | pre-seed | seed | Round A | Round B |

Europe | 3,22% | 1,39% | 3,95% | 2,19% |

USA | 2,67% | 0,51% | 2,85% | 3,89% |

China | 8,45% | 3,99% | 8,54% | 9,95% |

Rest of Asia | 2,24% | 1,62% | 4,12% | 3,20% |

Rest of world | 1,43% | 0,96% | 2,78% | 3,51% |

The takeaway is straightforward: regardless of stage, China’s robotics share outperforms. Nearly one in ten Chinese startups raising a Series B is a robotics company. That kind of participation rate doesn’t happen by accident; it’s the product of sustained investment in automation, supply-chain localization, and dual-use technologies—plus a go-to-market environment that rewards fast deployment in energy, manufacturing, logistics, and municipal services.

Momentum is on China’s side. Year-to-date through Q3 2025, robotics funding there has already surpassed the entire 2024 total – which itself was a global record year for the category. Absent a sharp policy shock, it’s reasonable to expect Chinese robotics to close 2025 at a fresh all-time high. For capital allocators, the signal is clear: if you believe share leads dollars, then the next leg of category leadership will be decided where robotics is gaining the highest penetration across stages – and right now, that’s China.

What’s Europe getting wrong?

On paper, Europe should be a robotics powerhouse: deep benches in mechatronics, world-class manufacturing know-how, and a long history of scaling complex hardware. In practice, the scoreboard tells a tougher story. The continent’s standout mega-rounds – Wayve ($1.05B, UK) and CMR Surgical ($600M, UK), followed by Exotec (FR), Agile Robots (DE), DistalMotion (CH), and Quantum-Systems (DE)—are impressive but isolated when set against the sheer volume coming out of the U.S. and China.

Stage-by-stage, Europe’s share of robotics startups falls as companies mature. Combine that with the fact that roughly 80% of funding is domestic, and a pattern emerges: we’re short on late-stage hardware capital. The result is a structural cap on growth and a tendency toward earlier exits – often before platforms hit true scale.

The capital mix is another red flag. Between 2018 and 2025, only 41.7% of European robotics dollars went to companies doing any manufacturing. In North America and Asia, that figure was 89.4% and 80.7%, respectively—nearly 2× higher than Europe. Too many “deep tech” investors here favor industrial software and then badge it as robotics. That can generate nice margins, but it starves the physical layer -the very place where defensibility, data moats, and long-term value accrue.

There’s also a demand-side gap. As the category skews more defense/industrial, the U.S. benefits from scale in public procurement and a mature dual-use market. Europe’s adoption cadence and purchasing mechanics are slower and more fragmented, which suppresses rollout velocity and makes it harder for startups to stack repeatable deployments.

The fix isn’t mysterious: deepen late-stage hardware pools, tie capital to verified operational KPIs (uptime, autonomy levels, safety cases), and streamline procurement for dual-use and industrial automation so pilots can graduate to multi-site contracts. Europe has the talent and the factories; what’s missing is the scale engine that rewards shipping robots – not just slides.

Tips

For founders:

- Build standardized products: minimal custom work, <4-week installs, ROI <12–18 months. SLAs and >95% uptime win deals.

- Monetize software/fleet/data. Capture ops data early; make safety cases and compliance your moat.

- Aim at high value-per-minute verticals (energy, logistics, infra). Partner with integrators and others who will help you scale.

- Skip owning factories early. Scale through qualified CMs/EMS, dual-source critical parts, lock QA and supply agreements—avoid CapEx traps.

- Get a guy who will manage working capital and hardware cash cycles, and design a forward funding stack (equity + non-dilutive)—especially vital in Europe.

- Choose investors who truly get hardware: BOM-down roadmaps, certification/safety timelines, field ops, and access to integrators/industrial buyers.

For investors:

- Back embodied-AI with repeatable rollouts; avoid one-off hardware. Prefer platforms with integrator channels and multi-site pipelines.

- If you haven’t invested in hardware before—and there’s no true hardware specialist in the round—pass. Robotics isn’t a marketplace; it’s safety/regulatory, supply chain, and CapEx discipline. Experience here is non-negotiable.